Written by Jack Dyer, Broker of Record

A colleague recently brought an interesting article to my attention published in Real Estate Magazine (REM). In the piece the author, Paul Maranger, writes that supply is everything in real estate. He argues that those following the real estate market should ignore all statistics but two: months of inventory and sales-to-new-listings ratio, also known as the “Absorption Rate.” It is these figures alone that indicate whether the market is in under-supply (a seller’s market) or over-supply (a buyer’s market).

According to Mr. Maranger, a buyer’s market occurs when the available listing inventory (number of active listings divided by number of monthly sales) exceeds five months and the sales-to-new-listings ratio (number of sales divided by number of new listings) falls below 40 per cent. The opposite is true for a seller’s market. A balanced market is the transitional stage between these two extremes.

After doing my own research, I could not find a consistent answer to what statistically constitutes a buyer’s or a seller’s market. There are no industry-wide definitions. I do feel, however, the guidelines suggested by the writer seem reasonable in our marketplace.

Where do we stand in our Region?

Using the above definitions, I thought it would be interesting to analyse our region’s MLS statistics to determine where real estate stands during COVID-19. I think the results may surprise you.

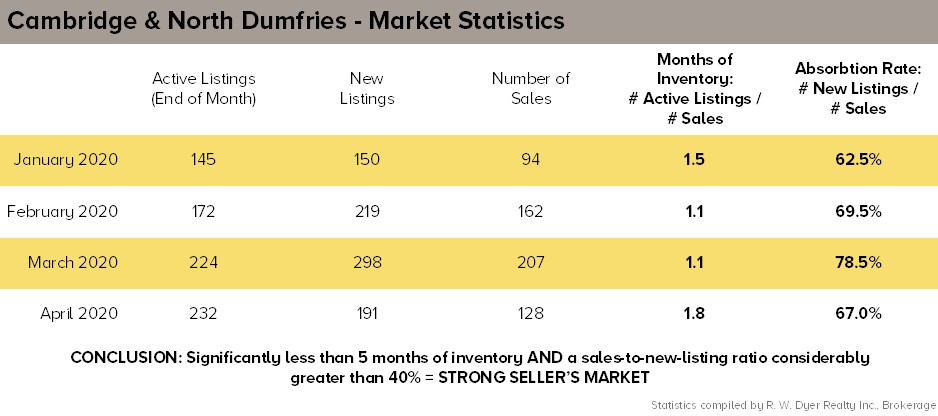

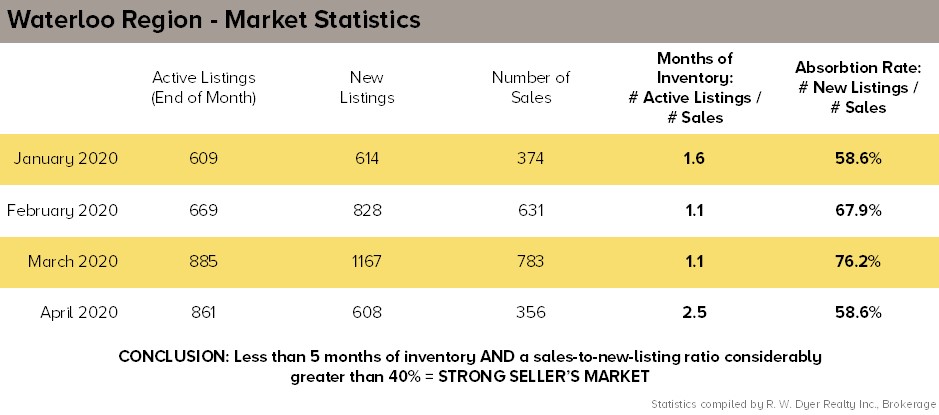

The chart below shows MLS statistics referenced in the article from both Cambridge and Waterloo Region as a whole.

What these numbers indicate is that even in the throes of a world-wide pandemic, our region sits squarely within a strong seller’s market. Although absorption rates slowed and inventories increased in April, we are still a considerable distance from buyer’s market territory.

Within our office, our team of sales representatives are working hard with our buyer clients to help them navigate the purchasing process in what is still a very competitive market. This is especially true in the price bracket most common for first-time home purchasers ($300-500K).

What do we recommend?

Although current market conditions favour sellers, this could be changing. Four to six months of diminished sales combined with steady listing activity (on par with April) could transition us into a buyer’s market. Assuming economic issues brought to the forefront by COVID-19 will persist in the coming months, the market may change course.

Given this possibility and speaking strictly from a market perspective, now seems like a very good time to sell. The fact that average sale prices in Waterloo Region have increased by a blistering 14.8% between the first quarter of 2019 and 2020, bolsters the sell now argument.

Buyers on the other hand, face a difficult decision: whether to buy now and get a foot into the market or to wait it out for a few months to see if a transition does happen. It is hard to imagine a scenario where the long-term economic impact of COVID-19 does not have some cooling effect on real estate.

We at Dyer Realty strongly believe the purchase of real estate in our region, if bought for the long-term, is the best investment an individual can make. We will continue to monitor market conditions to provide our clients with up-to-date information and timely advice.

If you have questions relating to the purchase or sale of real estate during COVID-19, please do not hesitate to reach out to a member of our team.